Are you getting the most out of depreciation?

On the 9th of May 2017, the ATO announced sweeping reforms to the depreciation laws that have really changed the game for property investors.

While the changes present some challenges for investors, one benefit is that buying new property is more affordable (from a cash flow perspective), than investing in second-hand property.

The New Rules:

- If you acquire a second-hand residential property after May 9, 2017 which contains “previously used” depreciation assets (those installed by a previous owner). you will no longer be able to claim depreciation on those assets. However, you can still claim depreciation on the structural elements of the building.

- If you invest in brand-new property, you can claim depreciation on both the structure of the building and the highly depreciable assets (such as flooring, appliances, window treatments, etc)

Why it matters

Those non-structural assets show wear and tear faster than structural assets. Therefore, investors in new property will be able to claim a significant portion of their depreciation in the early years, when they can benefit most from lower taxes and better cash flow

The bottom line: Investing in brand-new property has undeniably fantastic cash flow advantages.

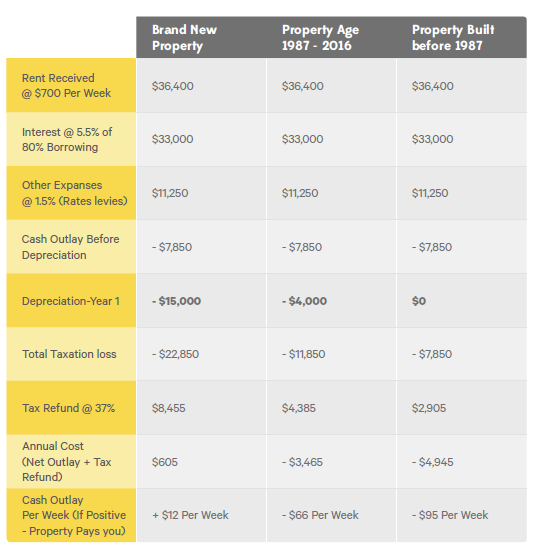

The best way to understand how the changes work is to analyse the cash flow benefits by the numbers. Let’s compare three residential property investment options:

- A brand-new unit.

- A unit built between 1987 and 2016, where building allowances (structural things like bricks, concrete, etc.) can be claimed but not assets (non-structural things like appliances, flooring, etc.)

- A property built prior to 1987, where no depreciation on the building or assets can be claimed.

As you can see, buying new property means lower taxes and better cash flow early on, making your investment more affordable!

ParkTrent are able to put you in touch with the best experts in tax depreciation for investment properties and accredited quantity surveyors. If you are interested in making sure you are getting the most out of your current portfolio be sure to get in contact with Warren who will be able to tell you more about a special offer we have for ParkTrent clients to get a depreciation report that will save you up to 25% off the standard report fee.

If you would like more information, please contact us on (02) 4225 2440 to make an enquiry.